In October I blogged “The ups and downs of gasoline prices this year has seen a 50% increase in gasoline prices over a year ago.” Is this a record increase? Are prices at an all-time high? The answer to both those questions was NO.”

Highest Price

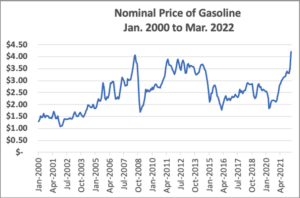

Is it time to reconsider? The answer is IT DEPENDS (an answer economists like to use). According to the U.S. Energy Information Administration (eia.gov), the average price of a gallon of gasoline reached $4.22 a gallon in the U.S. this past month, the highest nominal price ever and 16¢ higher than the previous record of $4.06 in July of 2008. So YES, it is at an all-time (nominal) high.

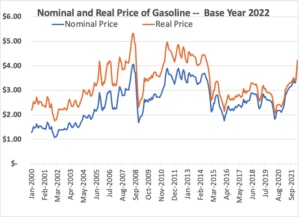

But most economists say that to compare prices over time, we need to convert this into the real price; that is, we need to adjust this nominal price for changes in the CPI.

In the second chart, we add the path of real prices to that of nominal prices, using the CPI (March 2022 base) to make the adjustment. When we do that, there were many months in which the real price was higher than in March 2022. For the 40 months from March 2011 to July 2014, 32 of them had a real price higher than $4.22. So, the answer is NO to it being an all-time high gasoline price if we correct for inflation.

But this may seem like a sleight of hand. Gasoline prices are a part of the CPI. So, when gasoline prices go up, then won’t the CPI go up too? Yes, it does. The real price shows how gasoline’s price has changed relative to the price of everything else households buy. So, the $5.33 real price of a gallon of gasoline in June of 2008 means that, relative to everything else households bought that month, gasoline then was equivalent to a price of $5.33 today.[1]

“So What?” says a person watching the numbers on the gasoline pump go up and up. “I don’t care if you call it real price and tell me that it is not as expensive relatively, whatever that means. I am sure everything is more expensive now than it has ever been. Buying gasoline drains my paycheck faster than ever before.”

This is an understandable feeling; however, it is wrong. Deflating by the CPI is a legitimate way to see if an item has become relatively more or less expensive. However, it does not deal with the question of what an item is taking from our paychecks.

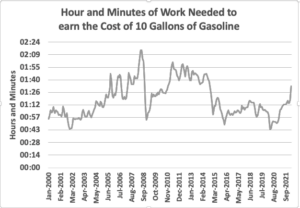

To answer that question, we present a third graph using a measure we feel is far more meaningful than correcting for the CPI. This graph shows the amount of time a person needs to work to earn enough to buy ten gallons of gasoline. We will call this the labor cost. In January 2000, the average hourly wage was $13.75[2] and the price of ten gallons of gas was $12.90. $12.90 divided by $13.75 is .938 and that multiplied by 60 minutes gives 56 minutes. Thus, it took a little less than an hour of work to earn enough to buy 10 gallons of gasoline. By the end of 2001, it was down to 44 minutes, but then by June of 2008 it was up to the highest value for this century so far –2 hours and 14 minutes.

Today, the labor cost of 10 gallons is 1 hour and 33 minutes or 41 minutes less than the labor cost of a little over 13 and a half years earlier. The labor cost of gasoline in March of 2022 was 75% of what it was in June of 2008. For the 267 months since January 2000, 72 of them have a labor cost of gasoline greater than March 2022.

The Rate of Increase?

What about the question whether this is a record rate of increase? The answer is YES; this is the largest one-month percent increase of gasoline prices in the 21st century by all three measures: 20.0% nominal, 18.5% real, and 19.6% labor cost. But complaints about rising gasoline prices began before this past month. For the first quarter of 2022, the increases have been 27.7%, 23.8% and 26.2%, respectively. However, these are not record increases for a quarter. Five other three-month periods during this century had faster increases with the largest being the Spring of 2007 when it went up 38.1%.

Conclusions

The nominal price of gasoline reached an all-time high in March 2022 and appears to have declined slightly since. By two other measures, however, the March price increases were not records. In fact, the labor cost was higher in 27% of the other months of this century. The rate of increase this year has been rapid for understandable reasons. However, there have been periods of more rapid increase in the past.

In my opinion, some of the recent reactions to the gas price increase have been unnecessary. The economy can (and has) coped with higher gasoline prices measured in real terms or labor cost and if that will promote reduced consumption, the environment will benefit. Here is a link to the data used.

[1] If gasoline prices changed at the same rate as the CPI, then the real price would be constant.

[2] This number if from the BLS series titled “Average Hourly Earnings of Production and Nonsupervisory Employees, Total Private, Dollars per Hour, Monthly, Seasonally Adjusted” https://www.bls.gov/news.release/empsit.t24.htm